In this auspicious occasion, we are delighted to delve into the intriguing topic related to Iowa Income Tax Rates 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

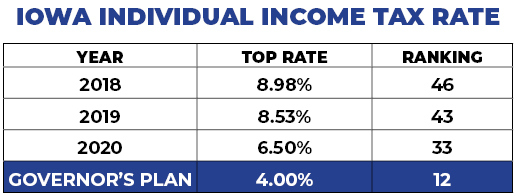

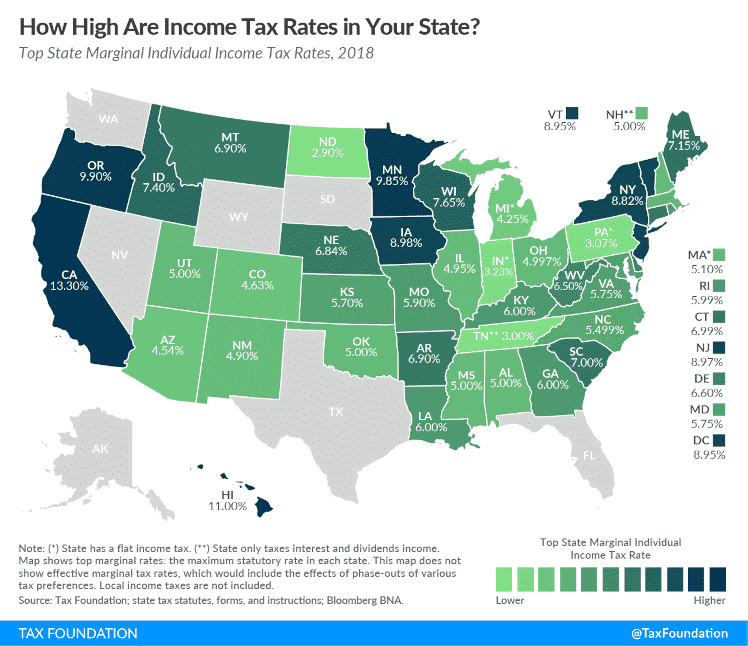

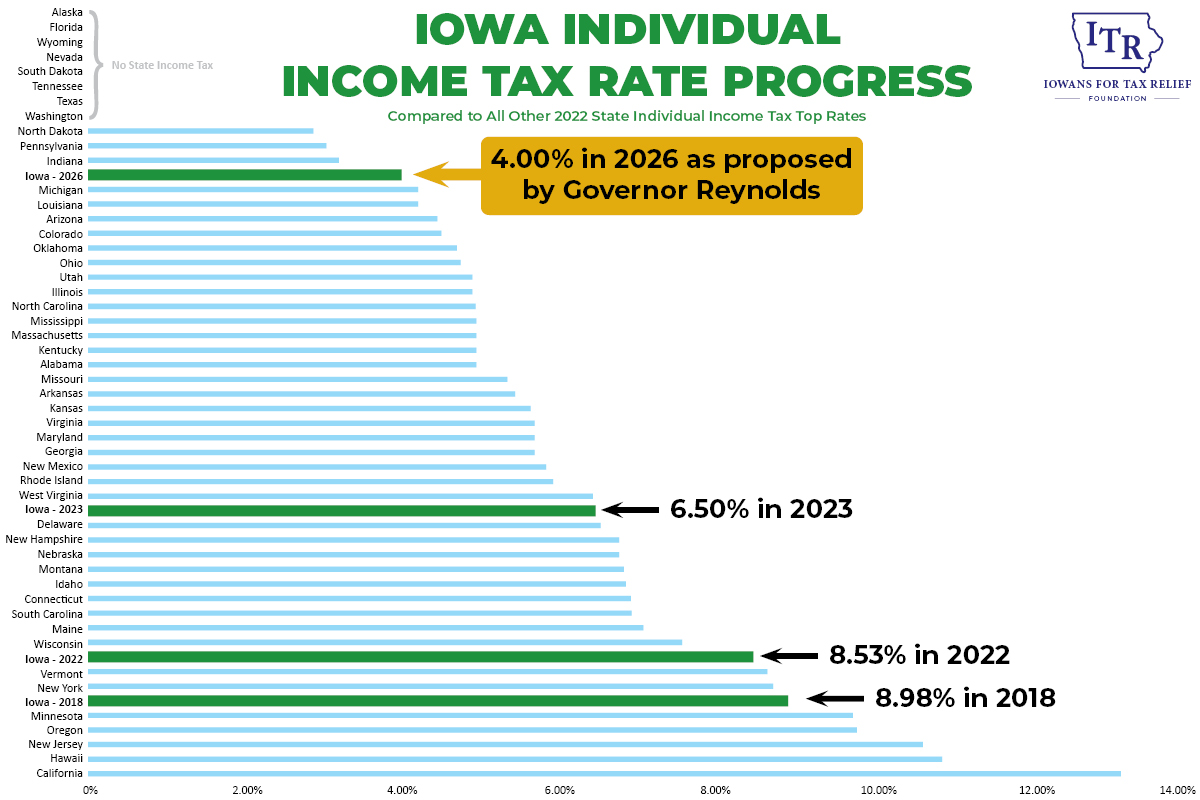

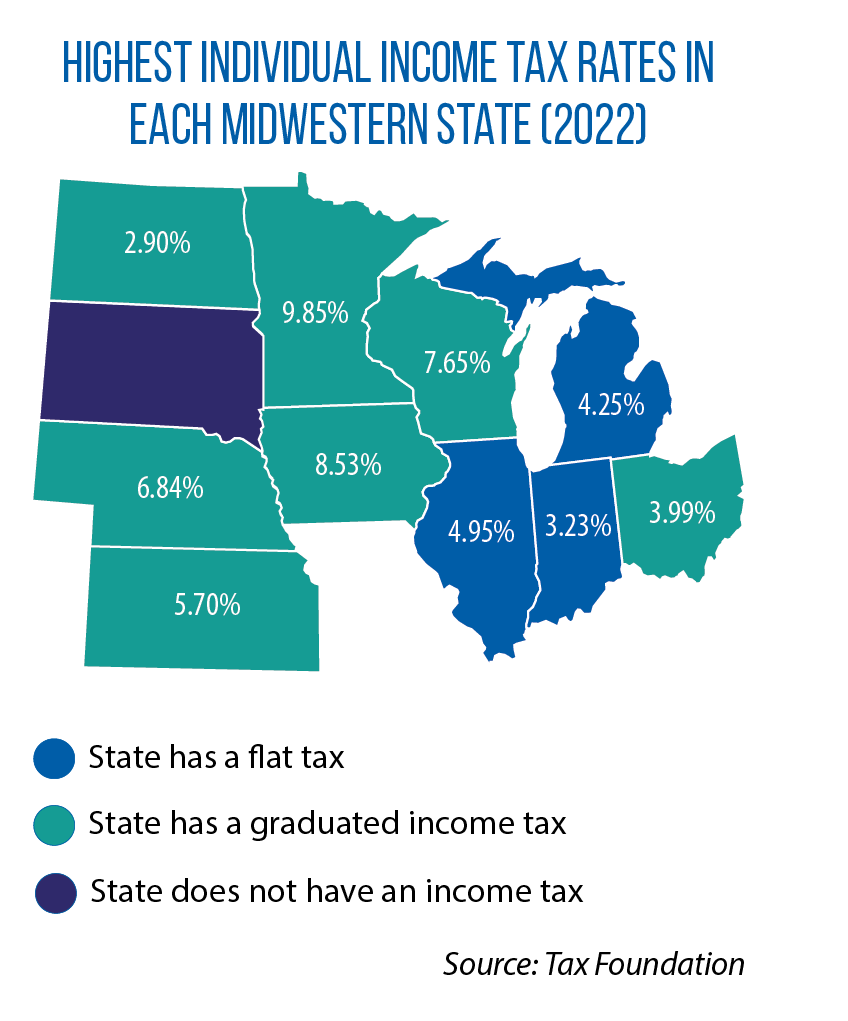

The Iowa income tax system is a progressive tax system, meaning that the tax rate increases as the taxable income increases. The tax rates for 2025 have been recently released by the Iowa Department of Revenue. This article provides a comprehensive overview of the Iowa income tax rates for 2025, including the various brackets, deductions, and credits.

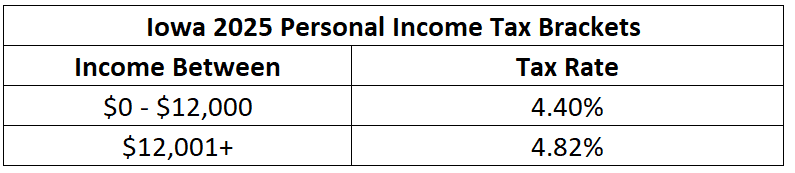

The Iowa income tax rates for 2025 are divided into nine brackets, with each bracket having a different tax rate. The brackets and their corresponding tax rates are as follows:

The due date for filing your Iowa income tax return is April 30, 2025. However, you can request an extension to file until October 15, 2025.

The Iowa income tax system for 2025 is designed to be fair and equitable for taxpayers of all income levels. By understanding the tax brackets, deductions, and credits available, you can accurately calculate your tax liability and ensure that you are paying the correct amount of taxes.

Thus, we hope this article has provided valuable insights into Iowa Income Tax Rates 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!