Virginia income tax filing deadlines by tax year. You will later receive an electronic acknowledgement that the irs has accepted your electronically filed return.

If you file your state income tax return and pay the balance of tax due in full by march 1, you are not required to make the estimated tax payment that would normally be due on jan.

31 of the following calendar year, or within 30 days after the final payment of wages by your company.

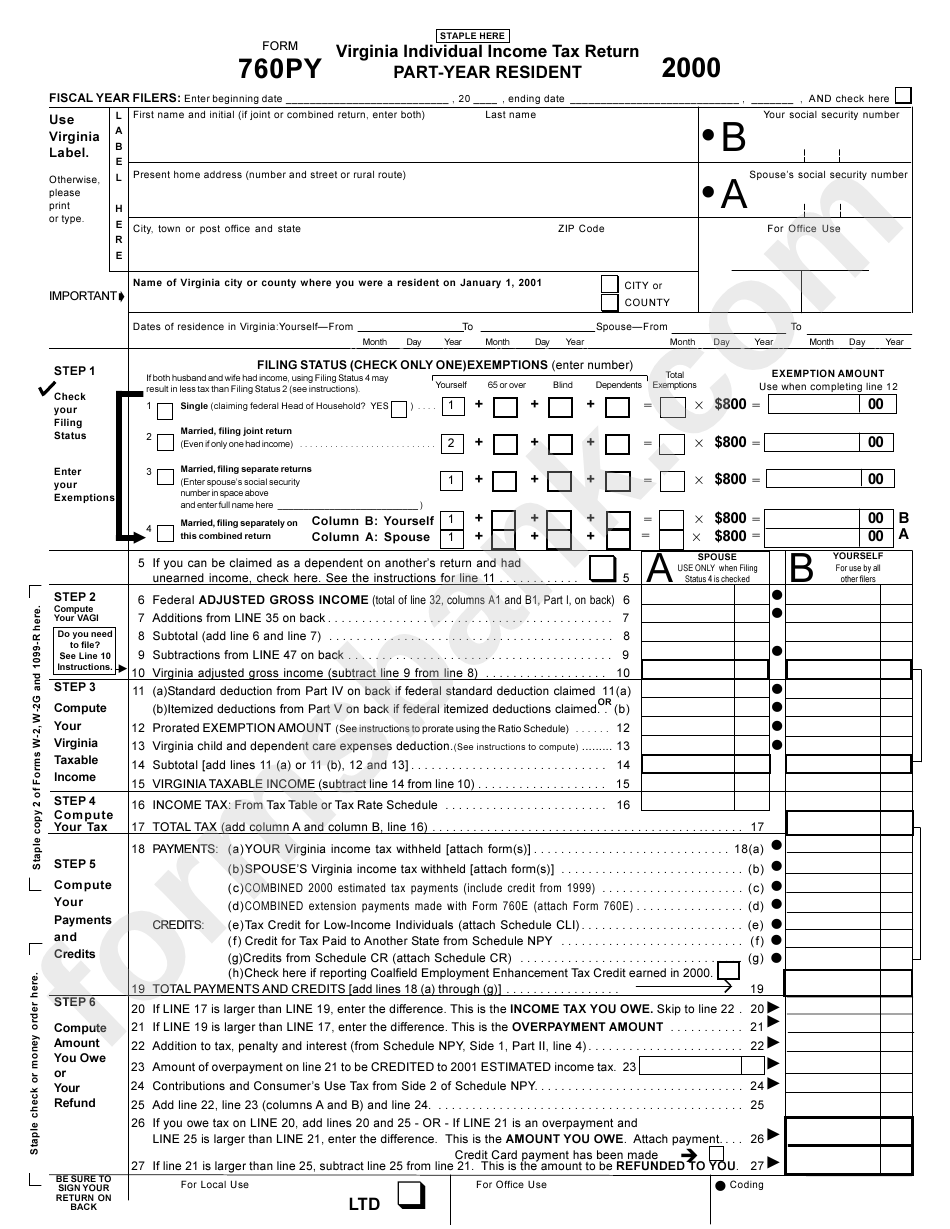

Virginia form 763 Fill out & sign online DocHub, Alaska, florida, nevada, new hampshire, south dakota, tennessee, texas,. If you request an extension, your deadline.

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, If the due date falls on a saturday, sunday or legal holiday, you may file your. Track the status of your state tax refund.

2025 Tax Refund Calendar 2025 Calendar Printable, Virginia income tax brackets 2025. 10, 2025, 10:53 pm utc.

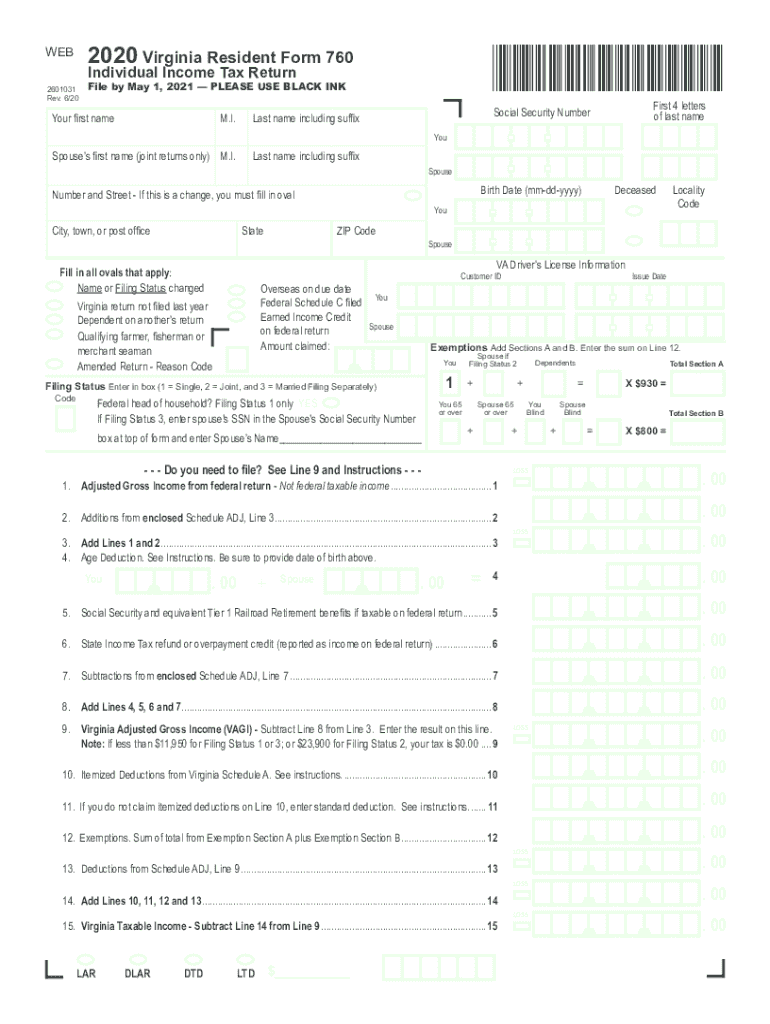

Va Tax Instructions for 760 20202025 Form Fill Out and Sign, Returns are due the 15th day of the 4th month after the close of your fiscal year. See your state department of revenue for.

Free Printable Virginia State Tax Forms Printable Form 2025, March 9, 2025, at 6:44 p.m. Tax season officially kicks off on january 29 this year, and federal tax returns are due on april 15th (with some exceptions).

Ast virginia tax Fill out & sign online DocHub, The deadline for 2025 is: Estimated income tax payments must be made in full on or before may 1, 2025, or in equal installments on or before may 1, 2025, june 15,.

Virginia State Taxes Deadline Commonwealth extends deadline for state, If you request an extension, your deadline. Virginia income tax filing deadlines by tax year.

Maximize Your Paycheck Understanding FICA Tax in 2025, Virginia has a graduated income tax, and its top income tax rate. Typically, most people must file their tax return by may 1.

Tax Rates 2025 To 2025 2025 Printable Calendar, If the due date falls on a saturday, sunday, or holiday, you have until the next business day to file with no penalty. March 9, 2025, at 6:44 p.m.

1099G/1099INTs Now Available Virginia Tax, Stay ahead of 2025’s biggest tax changes with this comprehensive, compelling report covering seven industries. Returns are due the 15th day of the 4th month after the close of your fiscal year.

*for all due dates.if a due date or deadline falls on a saturday, sunday, or , the due date or deadline is the following business date.